Use of cryptocurrency has been on the rise for the past few years, and Bitcoin is undoubtedly the most popular among them. However, with cryptocurrencies come taxes, and it’s crucial to understand how to pay taxes with Bitcoin and minimize your tax liability.

When calculating taxes on Bitcoin transactions, the IRS considers it as property. This means that any gains or losses from Bitcoin transactions are subject to capital gains tax.

The capital gains tax rate for Bitcoin transactions depends on the length of time the Bitcoin has been held. If Bitcoin is held for less than a year, it is subject to short-term capital gains tax, which is taxed at the same rate as ordinary income.

If Bitcoin is held for more than a year, it is subject to long-term capital gains tax, which is taxed at a lower rate.

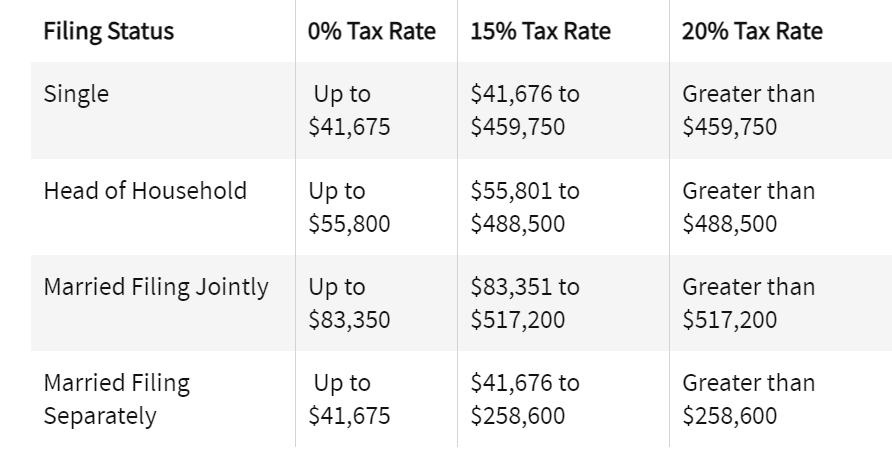

Here are the capital gain tax rates for 2022:

Note: these tax brackets are subject to change based on legislative and regulatory updates, and it’s always best to consult with a tax professional for individualized guidance and advice.

Now, paying your taxes with Bitcoin can minimize your tax liability, as it can help reduce capital gains tax. However, it’s essential to understand the tax implications of Bitcoin transactions. Don’t worry. we’ll cover best practices to help you with that.

Understand the Tax Implications of Bitcoin Transactions

When you sell Bitcoin, the increase in value from the time you bought it to the time of sale is taxable.

If you buy or sell Bitcoin, you need to report the transaction on your tax return. Failure to do so could result in penalties and interest charges.

The IRS determines the fair market value of Bitcoin for tax purposes. To calculate your tax liability when using Bitcoin to pay taxes, you should know these values.

If you mine Bitcoin as a business or trade, the Bitcoin you receive is subject to income tax. If you mine Bitcoin as a hobby, any profits are subject to capital gains tax.

Choose the Right Service Provider for Paying Taxes with Bitcoin

Several service providers allow you to pay taxes with Bitcoin. However, it’s essential to choose a reliable and secure service provider. Here are some tips that will help you choose the right service provider:

- Look for a provider with experience in cryptocurrency tax services. Check their website and reviews to see if they specialize in cryptocurrency tax and have a proven track record.

- Check the provider’s compliance with relevant regulations. The provider should comply with all relevant regulations in your jurisdiction.

- Ensure that the provider offers all the necessary tools and features for accurate reporting. The provider should offer accurate reporting of gains and losses, transaction history, cost basis, and other important data.

- Consider the pricing structure of the service provider. Some providers charge a flat fee, while others charge a percentage of your total tax bill. Choose the provider that offers the best value and meets your needs.

- Check the provider’s security measures. The provider should have robust security measures in place to protect your personal information and Bitcoin assets.

- Check for customer support. Choose a provider that offers timely and responsive customer support to help you with any issues or questions you may have.

By following these tips, you can choose the right service provider for paying taxes with Bitcoin, ensuring that the process is streamlined, secure, and hassle-free.

Plan Ahead to Minimize Your Tax Liability

Planning ahead is one of the best ways to minimize your tax liability. Here are some tips on how to plan ahead to reduce your tax burden:

Keep accurate records: Keep track of all your expenses and income throughout the year, including receipts and invoices. Accurate record-keeping will help you claim all available deductions and credits, reducing your taxable income.

Contribute to retirement accounts: Contributions to qualified retirement accounts such as 401(k)s or IRAs can reduce your taxable income, helping you save money on taxes.

Take advantage of tax credits: Tax credits are a great way to reduce your tax bill. Make sure you are aware of all the tax credits you qualify for and take advantage of them.

Plan for charitable donations: If you plan to make charitable donations, consider donating in bitcoin rather than cash. This can help you avoid capital gains tax while also receiving a tax deduction for the donation.

Consult with a tax professional: A tax professional can help you identify all available deductions and credits and provide guidance on how to structure your finances to minimize tax liability.

Final words

Paying taxes with Bitcoin can be advantageous as it can help reduce your tax liability. However, it’s essential to understand the tax implications of Bitcoin transactions and keep accurate records.

Also, choose a reliable and secure service provider that is compliant with state and federal tax laws.

Lastly, plan ahead to minimize your tax liability and schedule your payments strategically. By following these best practices, you can enjoy reduced tax liabilities and ensure a smooth process in paying taxes with Bitcoin.